A payment gateway enables customers to transfer funds to merchants using various payment methods, such as credit or debit cards, facilitating seamless online transactions. Despite its simplicity for users, it offers complex services through APIs, connecting millions of customers and merchants.

A payment gateway offers numerous services, but for this discussion, we will focus on the following functional and non-functional requirements.

Functional Requirements:

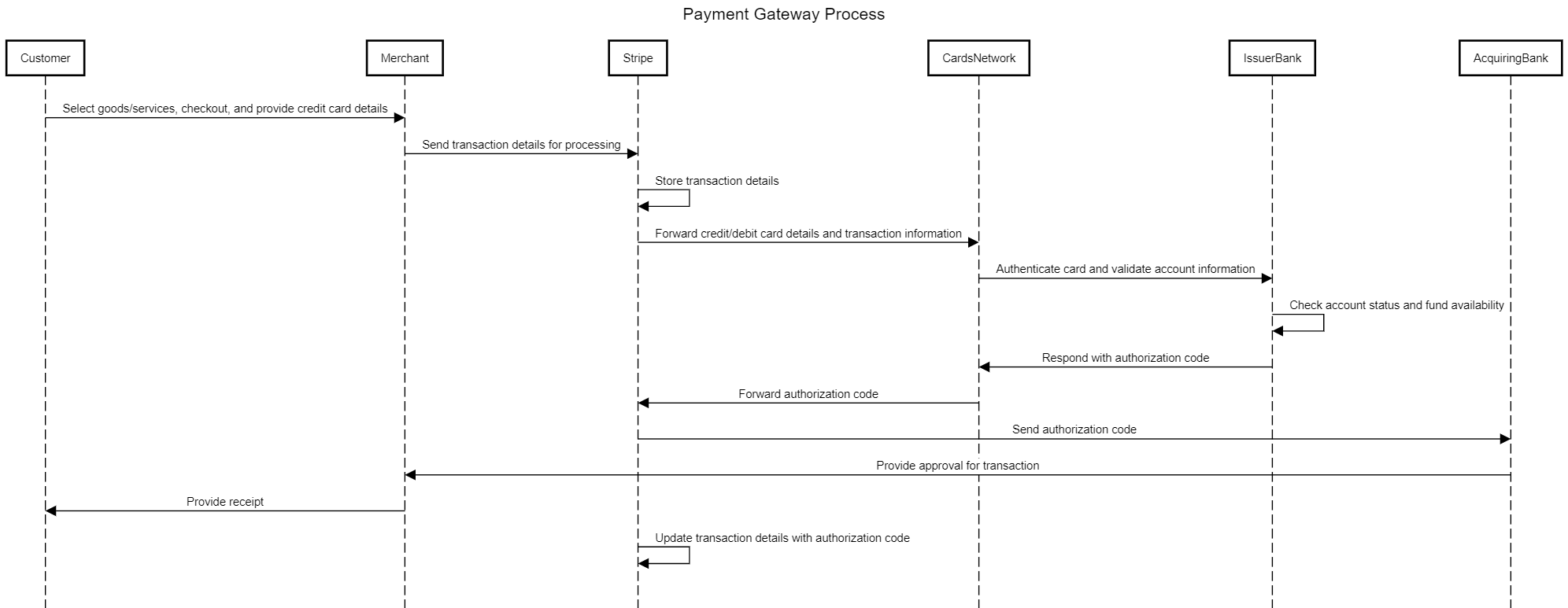

When a customer enters their credit card information on a checkout form, Stripe captures and tokenizes the data. This means the card details are replaced with a unique identifier, or "token," that represents the customer's payment information. Stripe then securely transmits the token to the card network in a manner that complies with PCI standards.

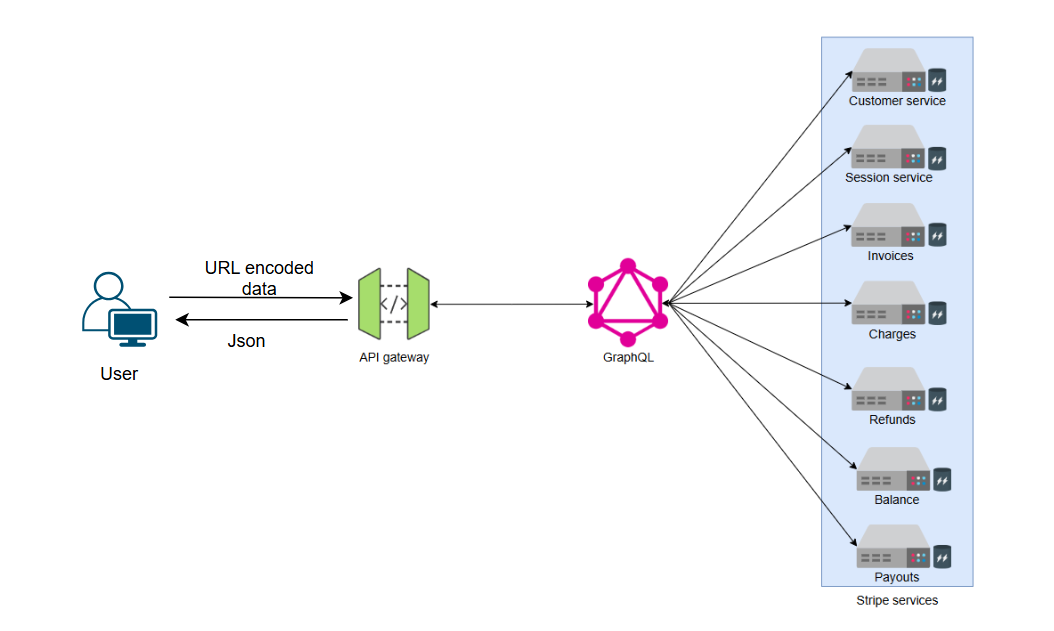

Stripe offers a wide range of services to its customers, each managing a different aspect of the payment process. In this discussion, we will focus on key services, including customer, session, invoices, charges, refunds, balance, and payout services, as illustrated in the figure below:

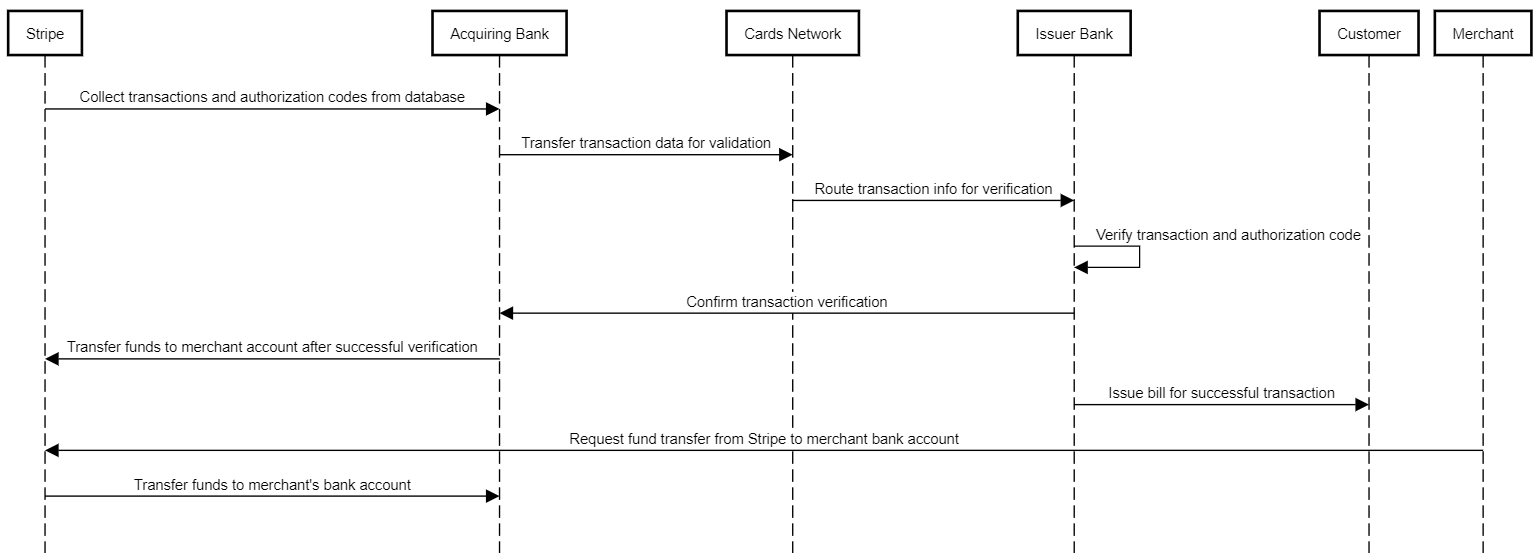

When a customer makes a purchase using a credit or debit card, the session service initiates and maintains the session throughout the payment process. To complete the transaction, the invoices service generates a bill for the customer, which is then paid using the charges service. If the customer requests a refund, the refunds service handles the process. The balance service tracks and manages the merchant’s balance. For example, the balance increases when a customer makes a purchase and decreases when a refund is issued. Additionally, the merchant can transfer a specified balance amount to their bank account through the payouts service. Having reviewed the design and workflow of Stripe, let’s now shift our focus to the key technical considerations needed to design the Stripe API.

When we examine the core usage of Stripe, we see that it is integrated into third-party applications. Customers begin the payment process by entering their card details. Both customers and merchants interact with Stripe through an API gateway, requesting access to various resources, such as checking account balances, retrieving invoices, or viewing transaction details. This interaction follows a request-response model, where each API call retrieves or modifies specific resources, allowing for the execution of CRUD (Create, Read, Update, Delete) operations. Given this pattern, the REST API architecture style is chosen as it aligns naturally with these use cases, providing an efficient and scalable solution for managing these interactions.

When the API gateway receives a request, it is parsed and converted into the appropriate format to either fetch or post data to the backend servers. A single request may require data from multiple endpoints, as it targets several interdependent services through the API gateway. For instance, the charges service handles the fund transfer after a transaction is successfully completed, while the customer service updates the merchant's account. Simultaneously, the session service continues to manage the user session. To streamline data from these multiple sources, a data federation strategy is needed. This can be effectively achieved by implementing GraphQL between the API gateway and backend servers, allowing seamless data unification.

| Design Considerations | Client-to-API Gateway | API Gateway-to-Backend Services |

|---|---|---|

| Architecture Style | REST | GraphQL |

| Data Format | URL encoded form data | JSON |

| Protocol | HTTP/2.0 | HTTP/2.0 |

To create a payment API like Stripe, it's important to consider both functional and non-functional requirements.

Strategies and methods to improve security and ensure data accuracy include:

Consistency:

This object represents a customer of your business. Use it to create recurring charges, save payment and contact information, and track payments that belong to the same customer.

POST /v1/customers

POST /v1/customers/:id

GET /v1/customers/:id

GET /v1/customers

DELETE /v1/customers/:id

GET /v1/customers/search

Session:

A **Checkout Session** is a temporary setup for your customer to complete their payment for one-time purchases or subscriptions. Each time a customer tries to pay, you create a new session to keep things organized. Once the payment is successful, the session saves the customer’s info and payment details. You simply create the session on your server and redirect the customer to its URL to start the checkout process.

POST /v1/checkout/sessions

POST /v1/checkout/sessions/:id

GET /v1/checkout/sessions/:id

GET /v1/checkout/sessions/:id/line_items

GET /v1/checkout/sessions

POST /v1/checkout/sessions/:id/expire

Invoices:

Invoices are bills for amounts owed by a customer, generated either as one-time or recurring from a subscription. Stripe can automatically charge the customer or send the invoice via email for manual payment. Before charging, Stripe applies any customer credits and adjusts the amount. If the amount is too small to charge, it’s added as credit for the next invoice.

POST /v1/invoices

POST /v1/invoices/:id

GET /v1/invoices/:id

GET /v1/invoices

DELETE /v1/invoices/:id

POST /v1/invoices/:id/pay

GET /v1/invoices/search

Charges:

The Charge object represents a single attempt to move money into your Stripe account. PaymentIntent confirmation is the most common way to create Charges, but transferring money to a different Stripe account through Connect also creates Charges.

POST /v1/charges

POST /v1/charges/:id

GET /v1/charges/:id

GET /v1/charges

GET /v1/charges/search

Refunds:

Refund objects allow you to refund a previously created charge that isn’t refunded yet. Funds are refunded to the credit or debit card that’s initially charged.

POST /v1/payouts

POST /v1/payouts/:id

GET /v1/payouts/:id

GET /v1/payouts

POST /v1/payouts/:id/cancel

POST /v1/payouts/:id/reverse

This is an object representing your Stripe balance. You can retrieve it to see the balance currently on your Stripe account.

GET /v1/balance

A Payout object is created when you receive funds from Stripe or initiate a payout to a connected bank account or debit card. You can view individual payouts or list all payouts. Payout schedules vary based on your country and industry.

POST /v1/payouts

POST /v1/payouts/:id/reverse

POST /v1/payouts/:id

GET /v1/payouts/:id

GET /v1/payouts

POST /v1/payouts/:id/cancel

# Create a customer

mutation {

createCustomer(input: { name: "John Doe", email: "john.doe@example.com", address: "123 Street" }) {

id

name

email

address

}

}

# Retrieve a specific customer by ID

query {

customer(id: "customer_id") {

id

name

email

address

}

}

# Retrieve all customers

query {

customers {

id

name

email

}

}

# Update a customer's information

mutation {

updateCustomer(id: "customer_id", input: { name: "Jane Doe", address: "456 New Street" }) {

id

name

email

address

}

}

# Delete a customer

mutation {

deleteCustomer(id: "customer_id") {

success

}

}

# Search for customers based on criteria

query {

searchCustomers(query: "John") {

id

name

email

}

}

Session

# Create a session

mutation {

createSession(input: { paymentMode: "card", shippingInfo: "456 Shipping St." }) {

sessionId

paymentMode

shippingInfo

}

}

# Retrieve a session by ID

query {

session(id: "session_id") {

sessionId

paymentMode

shippingInfo

}

}

# Retrieve line items from a session

query {

sessionLineItems(sessionId: "session_id") {

itemId

description

quantity

price

}

}

# Retrieve all sessions

query {

sessions {

sessionId

paymentMode

shippingInfo

}

}

# Expire a session

mutation {

expireSession(id: "session_id") {

success

}

}

Invoice:

# Create an invoice

mutation {

createInvoice(input: { applicationCharges: 100, tax: 10, dueAmount: 110 }) {

id

applicationCharges

tax

dueAmount

}

}

# Retrieve a specific invoice by ID

query {

invoice(id: "invoice_id") {

id

applicationCharges

tax

dueAmount

status

}

}

# Retrieve all invoices

query {

invoices {

id

applicationCharges

dueAmount

status

}

}

# Update an invoice

mutation {

updateInvoice(id: "invoice_id", input: { tax: 15, dueAmount: 120 }) {

id

tax

dueAmount

}

}

# Delete an invoice

mutation {

deleteInvoice(id: "invoice_id") {

success

}

}

# Pay an invoice

mutation {

payInvoice(id: "invoice_id") {

id

status

}

}

# Search invoices

query {

searchInvoices(query: "overdue") {

id

applicationCharges

dueAmount

status

}

}

Charge:

# Create a charge

mutation {

createCharge(input: { amount: 100, billingDetails: { name: "John Doe" }, customerId: "customer_id" }) {

id

amount

billingDetails {

name

}

status

}

}

# Retrieve a specific charge by ID

query {

charge(id: "charge_id") {

id

amount

status

}

}

# Retrieve all charges

query {

charges {

id

amount

status

}

}

# Search charges

query {

searchCharges(query: "pending") {

id

amount

status

}

}

Refunds:

# Create a refund

mutation {

createRefund(input: { amount: 50, chargeId: "charge_id" }) {

id

amount

status

}

}

# Retrieve a specific refund by ID

query {

refund(id: "refund_id") {

id

amount

status

}

}

# Retrieve all refunds

query {

refunds {

id

amount

status

}

}

Balance:

# Retrieve balance

query {

balance {

available

currency

}

}

# Retrieve a specific transaction from balance

query {

balanceTransaction(id: "transaction_id") {

id

amount

currency

}

}

# Retrieve a list of transactions from balance

query {

balanceTransactions(limit: 10) {

id

amount

status

}

}